Please note that the below daily coverage option is no longer available. For snow plow coverage needs, please contact Risk Placement Services.

Snow plow insurance (also known as snow clearing or snow removal insurance) can be difficult to decipher and with increased exposure and claims coupled with a limited set of insurance companies offering the coverage, it has made obtaining snow plow insurance coverage more difficult over the years. There is hope however. Platforms like Snow Clearing Insurance by J.H. Ferguson & Associates, leverages technology to enable pay-as-you-go daily coverages, making snow plow insurance more flexible and accessible.

Below, we attempt to summarize the daily insurance option, the snow plow insurance industry as a whole, what the different coverages provide and ways insurance for snow removal contractors can be used to control costs, while optimizing coverage.

Snow Clearing Insurance – The Daily Coverage Option

Snow Clearing Insurance by J.H. Ferguson & Associates provides liability coverage for snow plow operators on a pay-as-you-go daily basis. The coverage is for liability only (does not include commercial auto coverage) so the product is ideal for anybody that already has a commercial liability policy in place. Pricing starts at $135/day, with liability limits of $300,000, $500,000 and $1M. Deductibles range from $300 to $1,000 depending on the option chosen. It is currently available in 9 states (CT, MA, MD, ME, NH, PA, RI, VA, VT), with plans to expand further for the 2021/2022 winter season (CO, IA, IL, IN, MI, MN, OH, UT, WA, WI).

For additional clarity, this product is priced for those that do snow removal with a vehicle and operations are limited to properties under 25,000 square feet so large parking lots like those found at Walmarts and Home Depots would not be a fit for this coverage. Competing policies that start at $20/month usually do not cover motorized snow removal so it is important to know exactly what coverage you are getting.

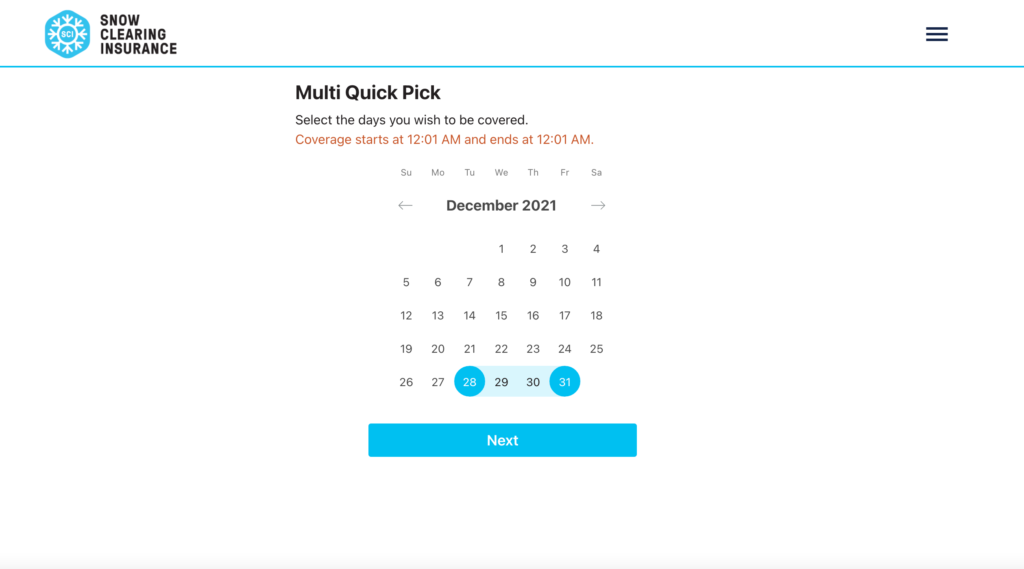

The coverage can be purchased and cancelled up until 11:59pm the day before the coverage starts. Same day purchases are not possible. The coverages period goes from 12:01am to 12:01am the next day so overnight snow removers will need to purchase two days worth of coverage.

As for the certificate of insurance (COI), this is automatically emailed to the insured after each purchase and it clearly states the coverage limits and date(s) of coverage.

According to the website:

This is a fast and easy commercial general liability insurance provided on demand – just for snow clearing professionals.

Commercial general liability coverage (premises and completed operations), limits available up to $1 million, blanket additional insured coverage – automatically provide coverage to those parties required by contract.

Coverage for auto liability and auto physical damage is NOT included – all autos performing snow clearing must have coverage with a separate auto insurance policy

This is just for snow clearing professionals – other business ventures or operations cannot apply for coverage

For more information, please visit www.snowclearinginsurance.com or contact them directly through this form. FAQs are available here.

The Snow Plow Insurance Industry as a Whole

The snowplow industry is a highly fragmented market. According to IBIS Worldwide:

- The nature of services provided by this industry hinders the ability of operators to expand their operations beyond a regional level. The majority of industry establishments are composed of local, one-man operation businesses and independent contractors.

- Clients like to work with companies which have a proven track record, adequate business liability insurance and access to well-trained personnel.

- Operators can also gain a competitive advantage by providing proof of contractor’s insurance or accreditation from a third-party organization such as Accredited Snow Contractors Association (ASCA).

When it comes to insurance, according to RB Insurance, placing insurance is becoming more difficult as more insurance companies pull out of the market. Also, a major cause for the increase can be attributed to increases in claims frequency and increasing medical costs. Even the two main snow removal associations, SIMA and ASCA have dedicated webpages for insurance because it’s an ongoing concern for their members.

For the above reasons, snow clearing insurance is an ideal option because it allows operators to quickly obtain snow removal coverage without having to update/change their existing business or commercial auto insurance policies. There also is no long term commitment since each policy is issued on a daily basis (or multiple consecutive days, if required).

Snow Plow Insurance 101

When it comes to snow plow insurance, there are many different areas that need to be understood. Personal and Commercial Auto policies do not automatically include General Liability insurance for snow plowing activities performed for income/operating as a business.

According to Erie Insurance:

If you’re only using your plow for personal use: For example, you’re plowing your own driveway or driving over to plow your brother’s driveway as a favor. Under an ERIE personal auto policy, liability and physical damage coverage is usually automatically extended to your plow, as long as you have those coverages purchased for your pickup truck.

If you’re making an income as a full- or part-time snow removal contractor: You’d need to purchase a commercial auto policy. Operating a business – or even a side hustle – presents risks that are not covered by a personal auto policy.

General Liability coverage can help protect you from third-party claims (i.e. the insured and/or their employees damaged someone’s property or caused physical harm) as well as the financial consequences of a lawsuit (i.e. legal defence, settlements, judgements, medical bills, and court-related fees) including coverage for policyholders who may be found liable for negligence. For example, if someone slips, falls and breaks a leg in a parking lot that has just been plowed, the person may then sue the snowplowing company for damages. A common mistake is to assume that a landscaping or other core business liability insurance covers losses for snow removal. It is up to the business owner to make sure that liability policies cover snow removal, and many properties require coverage of up to $1 Million, $2 Million or more.

Common factors affecting price:

- Your location

- Coverage needs

- Driving history

- Claims history

- Employees

- Your vehicles

- Type of areas that are being plowed

- Number of employees

In the end, maintaining the correct coverage is important due to the nature of the work and the legal environment, as specific coverages could be required by law or by contracts.

If you rely on a crew of workers that use their own vehicles, be sure to ask each member for a copy of their Certificate of Insurance with a liability limit that is at least equal to your limit. Also, it is very important to have a contract in place that includes indemnification language and obligation to name you as an additional insured.

Getting Started with Insurance For Snow Removal Contractors

Getting started with insurance for snow removal contractors can be overwhelming. However with Snow Clearing Insurance, it’s now possible to get the coverage needed, without having to commit to a whole season or annual policy. Especially for those that are new to the industry, the Snow Clearing Insurance daily option allows users to get coverage that is tied directly to work that is booked in the near future. This better aligns the insurance coverage (an expense) with revenues.

As stated above, because the policy must be purchased at least one day before the coverage day(s), it is important to keep an eye on the upcoming weather. It is also important to determine whether the snow removal will happen overnight (thus requiring coverage for two days), or if it can all be done before 12:01am of the following day. Also, for heavy snowfall areas, an annual policy may still be a better option depending on the number of days spent removing snow. A good way to determine the breakeven between daily policies and an annual policy is to take a snow removal liability policy annual policy estimate (excluding other aspects like commercial auto) and dividing that by $150 (a rough average daily premium based on the limit/deductible options).

For example, if an annual snow removal liability policy costs $10,000 and we divide that by $150, the rough breakeven between buying daily policies versus an annual policy is roughly 66 coverage days.

At the end of the day, it is important to ensure that the proper coverage is purchased, while being diligent on how often the snow removal occurs in order to optimize the best outcome between coverage and cost.

Other Coverages to Consider

The nuts and bolts of the coverage is the commercial general liability, but there are other coverages you may want to talk to your broker about and add on to your policy.

Equipment and Tools

Provides coverage for equipment and accessories, the property of others in your care, and other business tools from loss or damage, including theft.

Equipment Breakdown

Another form of coverage that protects your equipment. This policy covers the cost to replace or repair your equipment should it breakdown due to an electrical or mechanical issue, such as a snowplow break down.

Hired and Non-Owned Vehicle Coverage

Coverage designed to protect vehicles used in connection with your business that you don’t own, rent, lease, or borrow. For example, an employee uses their truck for business purposes and crashes it on a job site after losing control on some black ice. This type of coverage could cover the costs associated with repairing the truck.

Facts About Snow Plow Insurance

According to Risk Placement Services, the following locations are more difficult to place:

- Convenience Stores and Gas Stations with Convenience Stores, especially 24-hour locations

- Pharmacies, Hardware Stores, Big Box Stores, Large Grocery Stores

- Banks with Walkup ATMs

- Hospitals, Nursing Homes/Assisted Living Facilities, Surgical Centers

- Stadiums, Airports

- Public Roads, Railroads, Subway Locations

By location, snow and/or ice removal operations in Philadelphia and the five boroughs of New York (Manhattan, Brooklyn, Queens, The Bronx and Staten Island) are difficult to cover.