State Farm Wedding Insurance

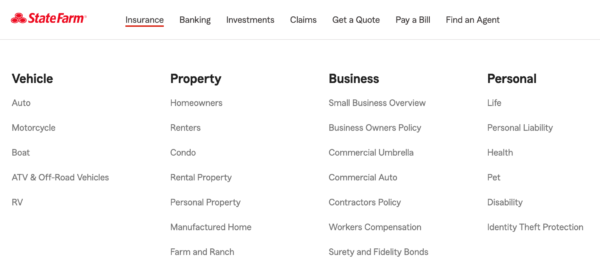

Looking for State Farm Wedding Insurance? It appears that State Farm does not prove a way to purchase a wedding insurance policy online (or even at all?).

If you're looking to purchase a quick and cheap policy online, GatherGuard and SpecialInsurance.com are great alternatives or see a full list of event insurance providers here.

Policies like State Farm Wedding Insurance (also referred to as Special Event Insurance) are purchased to protect the wedding host/couple from financial and legal burdens that could arise from injuries or property damages that occur during a wedding or event. Also, most wedding venues now require it as well as part of the rental agreement.

From a cost standpoint, event insurance policies can start at $75, however it is important to ensure the policy limits meet the requirements for the event and/or venue. For a list of companies that offer policies similar to State Farm Wedding Insurance, please see here.

The below video provides a very good reason to purchase coverage:

A wedding event insurance policy can protect the renter/organizer from lawsuits and financial losses that results from accidents and injuries that occur during the wedding. It also provides peace-of-mind allowing the policyholder to focus on the event.

Not convinced? Consider these examples where event insurance came to the rescue:

- Photographer’s camera bag with event pictures was stolen during the event. Hotel accused of failing to provide adequate security. Event Insurance paid $3,000 plus defense costs (legal fees).

- Venue held Rentee responsible for damaged carpet at reception. Event insurance paid $5,523.81.

- Wedding guest slips on rose flower. Event insurance paid $4,200.00.

- Groom while carrying his bride dropped her. Law suit against venue. Event insurance paid $12,250.00.

- A guest was injured in a fall on a slippery dance floor. Law suit alleged hotel provided improper dance floor. Event coverage paid – $2,500 plus legal fees (defense).

- A guest moved antique dining table and two table legs cracked. Claim paid by Property Damage coverage – $1,865.

- Pregnant x-girlfriend crashes wedding ceremony. Groom’s sister fights x-girlfriend. Venue, Wedding Planner, Groom/Bride sued. Damages alleged were $120,000. Event insurance settled for $15,000.

- Elderly guest tripped over electrical cord taped to the carpet. Event coverage paid $15, 245.06 plus defense costs (legal fees).

- Guest became intoxicated, killed himself and two others whilst driving home from the event. Law suit filed under Dram Shop laws to hold hotel responsible. Event insurance paid $775,000 plus legal fees (defenses costs).

- Hosts held responsible for damaged table top and other property damages. Event insurance paid by Property Damage coverage – $7,000

- Emerald ring stolen during wedding event. Hotel sued for negligent security. Event insurance paid $11,250 plus defense costs (legal fees).

- Gifts were stolen from trunk of car. Event coverage paid $1,088.

- Conventioneer slips on ice/snow at venue. Sues Convention organizers and venue. Event insurance pays $24,500.00.

- Fire damage to venue caused by rentee. Event insurance paid $24,365.60.

- Man sues venue for false arrest/wrongful detainment after crashing wedding reception. Event insurance pays nothing, but spends $55,000 in defense costs.

- “Silly string” sprayed on guests at birthday party caught fire causing second & third degree burns to several children. Law suit filed against rentee and hotel for $1,000,000. Event insurance settled for $135,456 plus legal fees (defense costs).

- Multiple claims filed against hotel for food poisoning. Event insurance paid $4,360.20.

- Fire loss to venue’s ballroom. Event insurance paid $7,000,000 for property damage and loss of business income.

- Guest being interviewed on stage during a convention had heart attack and died. Estate sued for damages alleging that the stress caused by the interview contributed to guest’s death. Event insurance paid policy limits $1,000,000 plus legal fees (defense costs).

- Protester files lawsuit against venue for wrongful detention and false arrest. Event insurance pays $10,000 plus defense costs (legal fees) in settlement.

- Earthquake during convention dinner caused suspended ceiling and lights to fall injuring several guests (some severely). Rentee and Hotel sued for $10,000,000 (Building contractor and architect weren’t sued because the Statute of Repose expired). Event insurance paid $1,000,000 policy limits. Hotel’s insurance paid $6,500,000 plus defense costs (legal fees).

Disclaimer: The materials available on this site are for informational purposes only and should not be construed as advice or guarantees on any subject matter. The opinions and statements expressed through this site are the opinions of the individual author and may not reflect the opinions of JAUNTIN’. This blog contains general information which may not be current or accurate. For specific questions about insurance and any requirements, please contact your insurer directly.