How to Read an Event Insurance Certificate of Insurance (COI)

Introduction to Event Insurance Certificate of Insurance

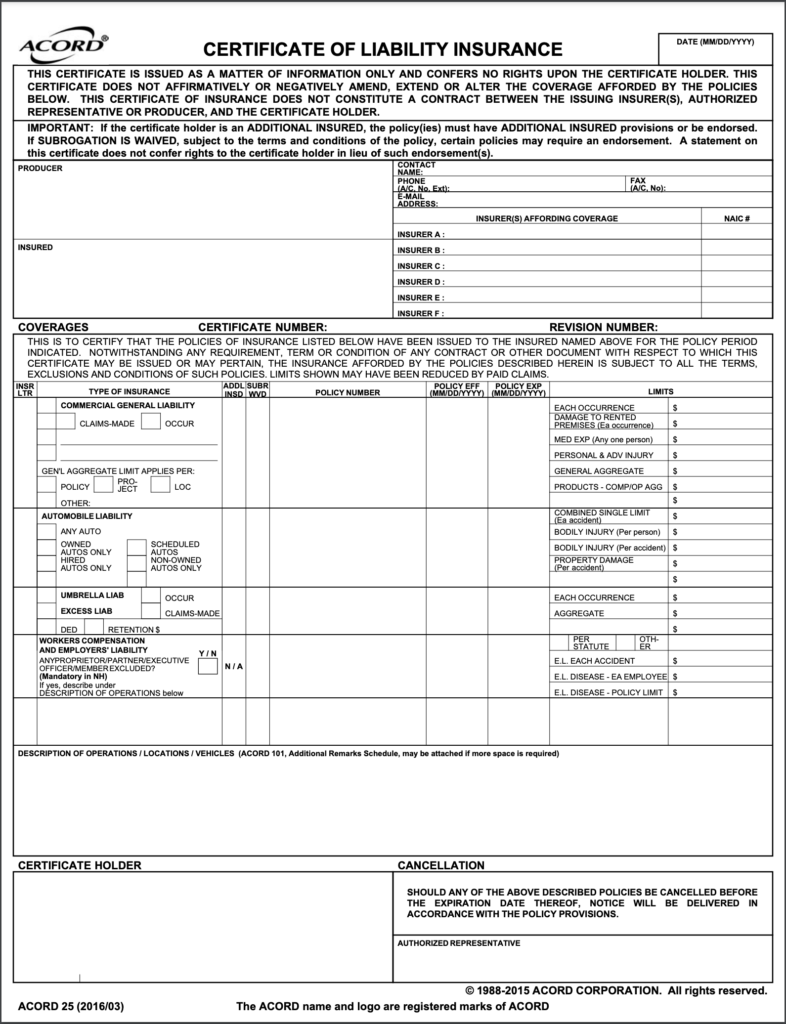

Welcome to this in-depth exploration of the event insurance Certificate of Insurance (COI). One of the most crucial aspects of managing these risks is securing adequate special event insurance coverage. However, understanding the intricacies of an event insurance COI can be challenging. It is a legal document that outlines the specifics of the coverage, and it’s essential to understand its contents fully.

The COI serves as proof of insurance. It details the types of coverage included in the policy, limits of liability, policy effective dates, and the name of the insured. Understanding how to read and interpret a COI can save you from potential pitfalls and ensure that your event is adequately covered.

Importance of Reading an Event Insurance COI

Why should you bother understanding an event insurance COI? Simply put, the stakes are high. Event planning involves a considerable amount of investment, both in time and money. Insurance acts as a safety net against unforeseen circumstances that could lead to financial loss. Therefore, understanding your insurance coverage is paramount.

An event insurance COI provides proof of coverage, but it also outlines the policy’s limitations. Misinterpreting or overlooking details could lead to insufficient coverage during a claim, potentially costing you thousands of dollars. Thus, the importance of reading and understanding your COI cannot be overstated.

Moreover, many venues require event organizers to provide a COI as proof of adequate insurance coverage. If you cannot comprehend your COI, you may face difficulty meeting venue requirements, leading to potential cancellations.

Understanding the Basics of an Event Insurance COI

A COI is a one-page document that summarizes the details of an insurance policy. It’s not the policy itself, but it gives an overview of the coverage. It includes the names of the insurer and insured, the policy period, types of coverage, and limits of liability.

The insurer is the insurance company providing the coverage, while the insured is the person or entity covered by the policy. The policy period indicates the effective dates of the coverage. The types of coverage could include general liability, property damage, workers’ compensation, and more. The limits of liability specify the maximum amount the insurer will pay for a covered loss.

While a COI provides essential information, it’s worth noting that it doesn’t include all policy terms and conditions. For complete information about your coverage, you should refer to the actual policy document.

How to Read an Event Insurance COI

Reading an event insurance COI might seem intimidating at first, but once you understand the basics, it becomes manageable. Start by looking at the names of the insured and the insurer. Ensure that your name or your company’s name is correctly listed as the insured.

Next, check the policy period. Make sure the dates align with your event schedule. Any discrepancy here could leave your event uninsured. Also, look at the types of coverage included in the policy. This section specifies what risks are covered, so it’s critical to understand each listed type.

Finally, review the limits of liability. These figures represent the maximum amount the insurance company will pay for a covered loss. Make sure these limits are sufficient to cover potential risks associated with your event.

Common Terms in an Event Insurance COI

As with any legal document, COIs are filled with jargon and terms that may seem confusing to the uninitiated. Here are some common terms you’ll encounter.

- “Insurer”: This is the insurance company providing the coverage.

- “Insured”: This is the person or entity covered by the policy.

- “Policy Period”: These are the effective dates of the coverage.

- “Types of Coverage”: This section specifies what risks are covered.

- “Limits of Liability”: These figures represent the maximum amount the insurance company will pay for a covered loss.

- “Additional Insured“: This is a person or entity not automatically included as insured under the policy but for whom the named insured’s policy provides a certain degree of protection.

Potential Risks of Not Properly Reading an Event Insurance COI

Not reading or incorrectly interpreting your event insurance COI can lead to several risks.

Firstly, you may think you have coverage for certain risks when you don’t, leading to significant financial losses if a claim arises.

Secondly, if your venue requires specific coverage and you fail to provide it, you could lose your venue reservation.

Finally, if you don’t understand your COI, you might not know your obligations as the insured. This could lead to unintentional breaches of your insurance contract, potentially resulting in the denial of a claim.

How to Purchase Event Insurance

Before securing a policy, be sure to ask your venue for their event insurance requirements. Doing so could save you hours of additional work.

Purchasing event insurance is a straightforward process with many insurers now providing online purchase options. Insurers that allow for online purchases include: Markel, GatherGuard, Allstate, SpecialInsurance.com, and State Farm.

Our Top Picks

GatherGuard

Starting at $75

Damage to rented premise limit: $250,000

Medical expense limit: Not included

Waiver of Subrogation Endorsement: No

Primary Noncontributory Endorsement: No

Deductible: $1,000

Terrorism Coverage: Included

Cannabis Coverage: Not possible

Free quote feature available

Specialinsurance.com

Starting at $160

Damage to rented premise limit: $300,000

Medical expense limit: $5,000

Waiver of Subrogation Endorsement: Yes

Primary Noncontributory Endorsement: Yes

Deductible: None

Terrorism Coverage: Can be added for an additional charge

Cannabis Coverage: Can be added for an additional charge

Free quote feature available

Coverage can extend beyond midnight depending on state liquor laws, in which case only 1 day of coverage is required

Disclaimer: The materials available on this site are for informational purposes only and should not be construed as advice or guarantees on any subject matter. The opinions and statements expressed through this site are the opinions of the individual author and may not reflect the opinions of JAUNTIN’. This blog contains general information which may not be current or accurate. For specific questions about insurance and any requirements, please contact your insurer directly.